Bain & Company‘s Global Private Equity Report 2024 is out, and makes for interesting reading. Some takeaways –

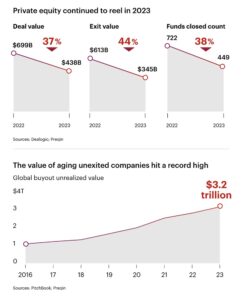

- As shown in the chart below, overall deal value is down by 37% and exit values are down by whopping 44%

- Private capital raising is a slog. There are a few winners but many more losers – no more than 20 funds accounted for all the buyout capital raised in 2023

- Portfolio holdings are ripe for harvest – nearly half of all global buyout companies have been held for at least four years, severely crimping return of capital to LPs

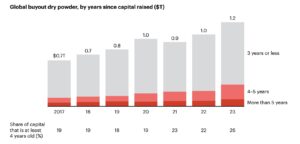

- Slowdown in deal activity coupled with years of strong capital raising mean buyout firms have a record $1.2 trillion in dry powder, more than a quarter of which is 4+ years old

- A moderating interest rate environment may further push GPs to put those record amounts of dry powder to work soon

- However, until exits start moving again, this is easier said than done – GPs have been forced to explore additional venues of value creation, specifically around improving operating leverage

- The time for GPs to take a clear-eyed look at their holdings is now – crucial to make the right call on what assets to cut (even if painful), where to partner with other sources of capital and which ones to double down on

- GPs need to leverage solutions like secondary market solutions including NAV financing, and continuation funds to recap their highest value investments and hold on for a better exit environment

Here’s a link to an FT article that discusses the report in greater detail.

My day job is advising growing companies on fundraising and M&A. If you are an investor or entrepreneur I’d love to connect.